Price Setting is the process you use to define the monetary value of your products and services. This process directly impacts your market share and profitability.

Are you using traditional pricing approaches such as “matching market price” or “cost plus mark-up”? None of these approaches are optimal and often result in profit leakage and high price disparities.

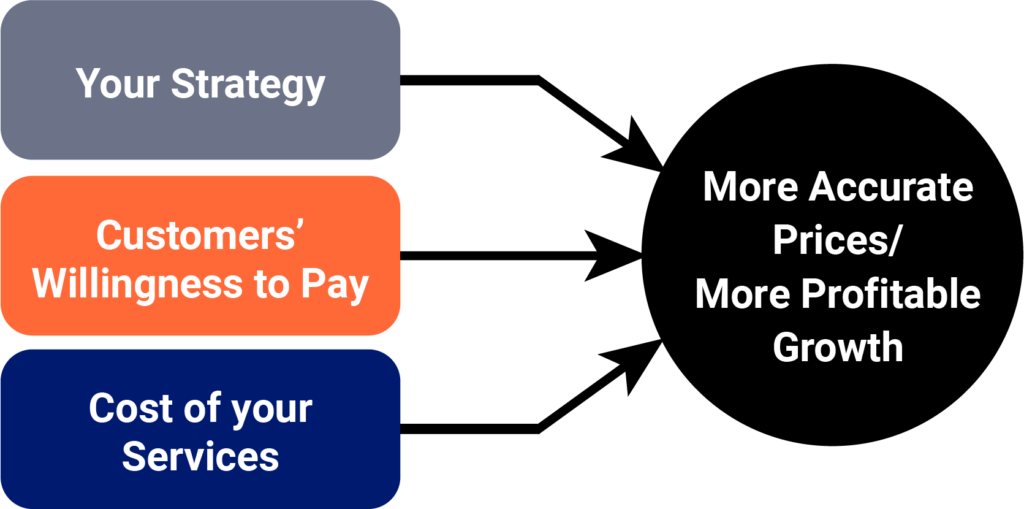

When setting the price of your services you must first clarify your strategy in the context of the market (profitability/growth/retention for each product category and customer segment) and then consider two other key factors:

- What is the cost of the service?

- How much are your target customers willing to pay (WTP) for these services?

WTP depends on competitive offers available in the market and how your offer compares with them, not only on price but also on value (transit time, convenience, reliability, etc).

Learn how a more accurate estimation of pricing factors can boost your profitability…

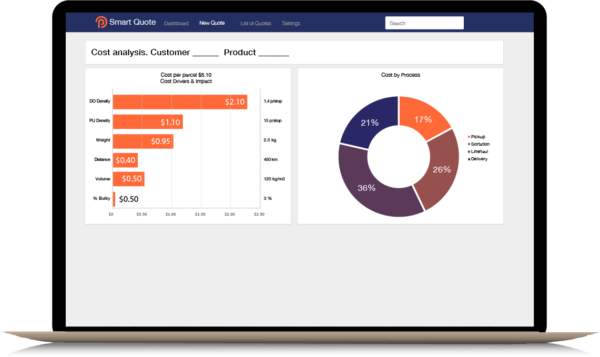

Effective Cost Modeling for Pricing

Many carriers do not use the right cost model for pricing, leading to unprofitable transactions (when costs are underestimated) or low conversion (when costs are overestimated). A unit cost per parcel for each product is not suitable, because the cost actually depends on multiple factors such as weight, size, distance, pickup density, delivery density, vehicle types, etc. Additionally, an effective cost model for pricing must segregate variable and fixed costs and, for these last ones, take into account capacity utilization with unit costs calculated at full capacity. Finally, a system of incentives and surcharges can be used to smooth shipping profiles and contribute to a higher network efficiency.

Learn how a more accurate cost model can boost your profitability…

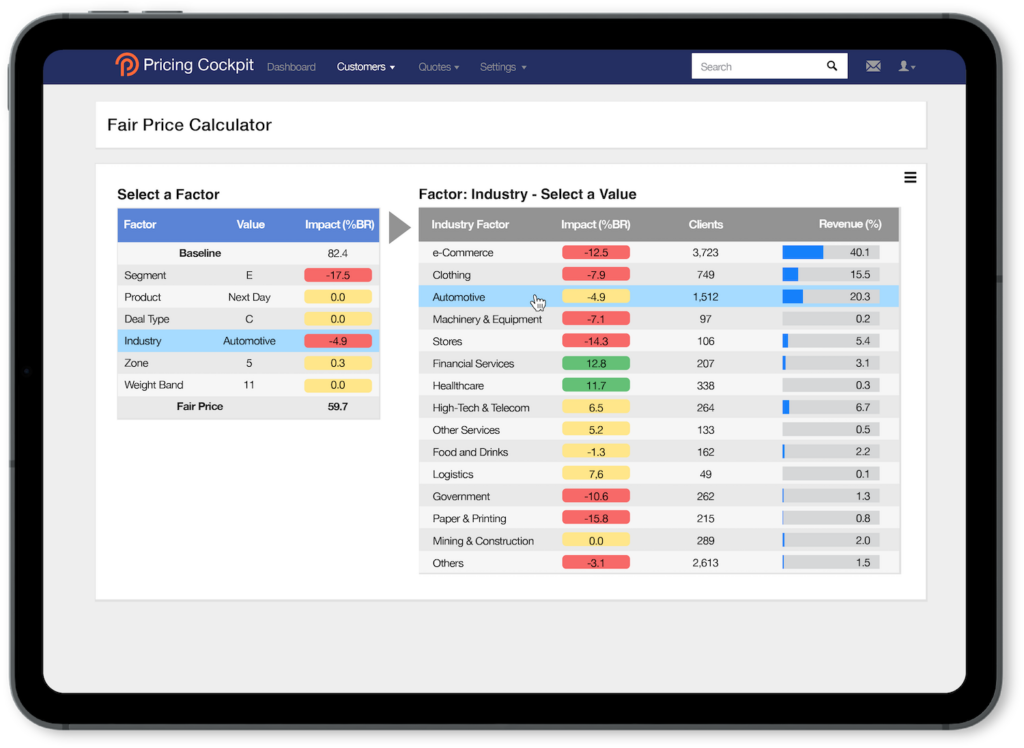

Price Segmentation by Willingness-to-Pay

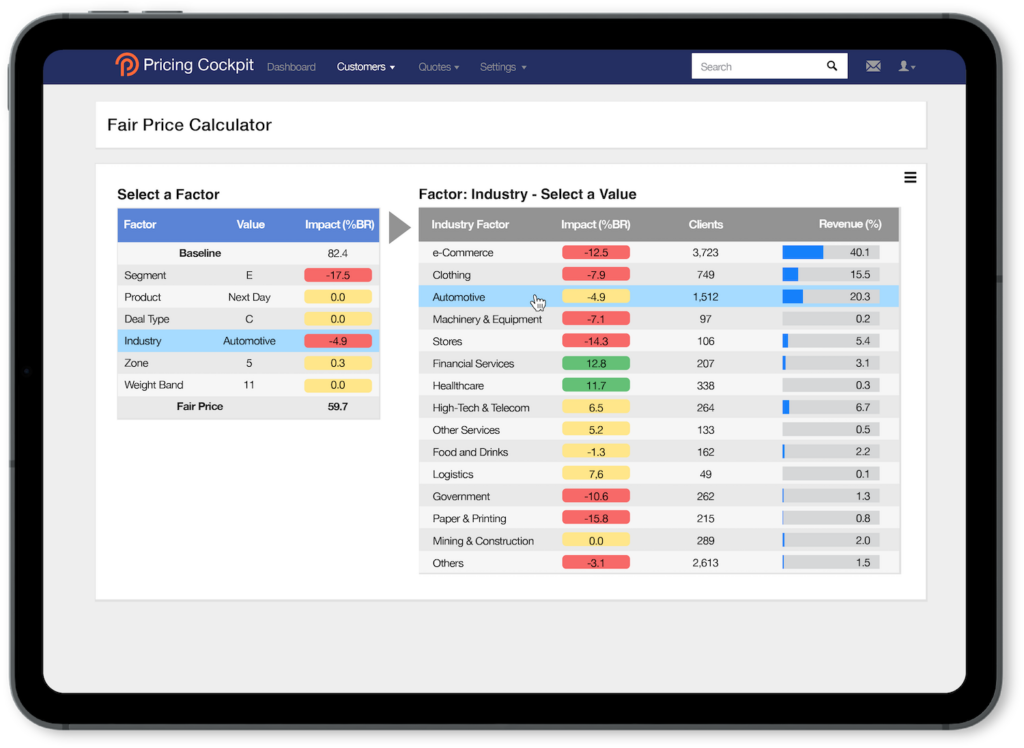

The Willingness to Pay (WTP) is the maximum price a customer accepts to pay for a given product or service. It varies from customer to customer depending on different criteria including customer characteristics, type of goods and competitive context.

Salespeople instinctively assess a customer’s WTP when building an offer and most price policies include discounts based on volume or revenue. However many WTP factors are ignored and, as a result, money is left on the table. By predicting WTP thanks to Machine Learning (applied to transaction price and win-loss analysis) and combining the results with market research and competitive intelligence, carriers can predict customers willingness-to-pay more accurately and significantly improve the effectiveness of their pricing decisions.

Learn how prediction of customers’ WTP can boost your profitability…

Price Segmentation by Willingness-to-Pay

The Willingness to Pay (WTP) is the maximum price a customer accepts to pay for a given product or service. It varies from customer to customer depending on different criteria including customer characteristics, type of goods and competitive context.

Salespeople instinctively assess a customer’s WTP when building an offer and most price policies include discounts based on volume or revenue. However many WTP factors are ignored and, as a result, money is left on the table. By predicting WTP thanks to Machine Learning (applied to transaction price and win-loss analysis) and combining the results with market research and competitive intelligence, carriers can predict customers willingness-to-pay more accurately and significantly improve the effectiveness of their pricing decisions.

Learn how prediction of customers’ WTP can boost your profitability…

Price Policies for logistics services

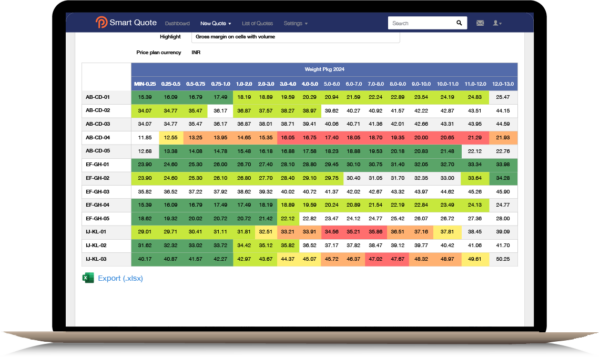

A price policy is the set of rules that define the prices for products, value-added services and surcharges. It provides guidance to sales reps for each negotiation consisting of a start price, a target price and a minimum price and corresponding threshold under which approvals are required. In the case of logistics services, a price policy consists of three elements:

- List Prices (LP) defined in the form of rate cards in general valid from one origin and varying by destination zones and weight bands (or other dimensions of the shipments such as number of pallets, cubic meters, loading meters, etc.)

- Discount Rules that sales can apply to offers, based on committed volume or revenue.

- Incentive Agreements (often referred to as conditional discounts or rebates) that sales can offer to increase a customer share of wallet and contribution margin.

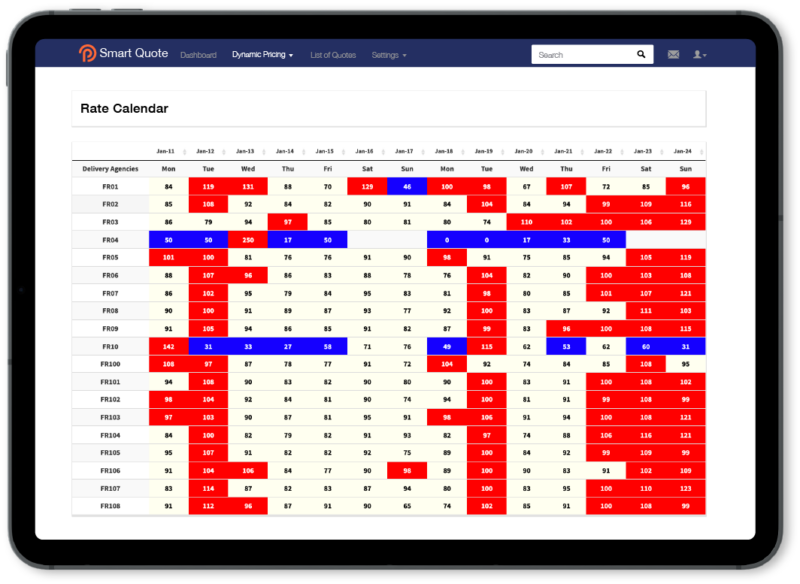

Dynamic Pricing

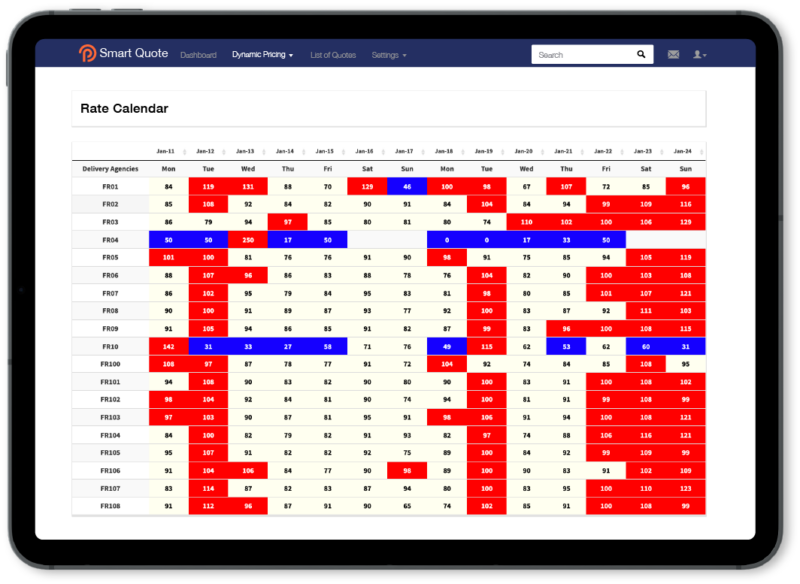

Dynamic pricing in logistics empowers you to enhance profitability and optimize capacity utilization. With Incentive Agreements, you can offer volume or revenue-based discounts promoting the increase of your customers’ share of wallet. Easily activate these incentives during quoting or rate adjustments, and track performance in real-time to ensure margin gains. Using Capacity Utilization metrics—such as seasonality, peak share, and predictability of key accounts—you can justify rate increases and apply surcharges when activity limits aren’t met. Rate Calendars enable you to strategically apply surcharges and incentives by delivery zone or timeframe, aligning pricing with demand fluctuations.

With dynamic pricing, you create optimized, transparent pricing strategies that not only improve network utilization but also give you a competitive edge in the logistics market. Learn more

Dynamic Pricing

Dynamic pricing in logistics empowers you to enhance profitability and optimize capacity utilization. With Incentive Agreements, you can offer volume or revenue-based discounts promoting the increase of your customers’ share of wallet. Easily activate these incentives during quoting or rate adjustments, and track performance in real-time to ensure margin gains. Using Capacity Utilization metrics—such as seasonality, peak share, and predictability of key accounts—you can justify rate increases and apply surcharges when activity limits aren’t met. Rate Calendars enable you to strategically apply surcharges and incentives by delivery zone or timeframe, aligning pricing with demand fluctuations.

With dynamic pricing, you create optimized, transparent pricing strategies that not only improve network utilization but also give you a competitive edge in the logistics market. Learn more