Price is not set by the market or by customers. It is a fundamental management decision. So how can you determine the optimal price for every sale transaction?

Pricing factors

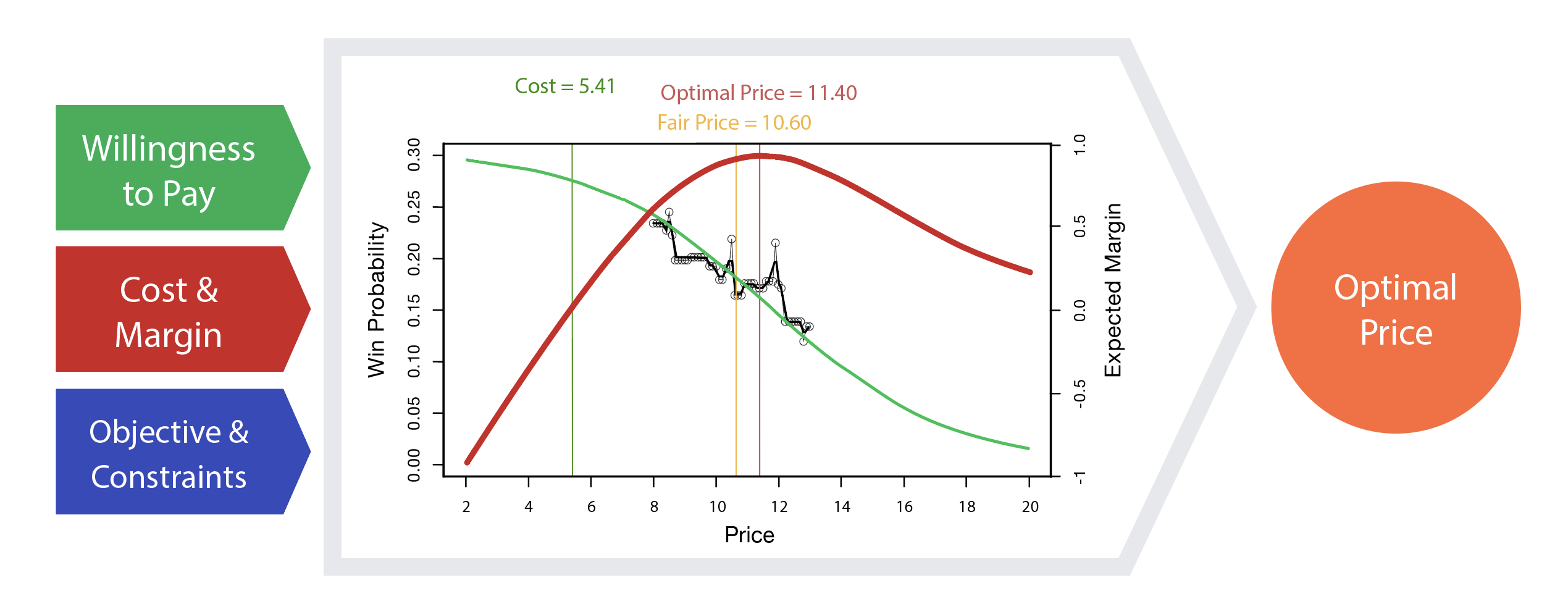

Three types of factors must be taken into account when making the right pricing decision. The process summarized on the following chart applies to any industry.

Let us illustrate this process in the case of a hotel.

The first factor to consider is the customer’s willingness to pay. It depends on the person’s characteristics and reasons for travelling, but also on the value conveyed through the brand of the hotel, its location, and competitors’ rates.

The second factor is the incremental margin generated by the transaction. The hotel will calculate variable costs associated with the sale (commission reverted to the distributor, food and beverage, room cleaning…) and also the opportunity cost (future demand at higher rates that will be displaced due to capacity limit).

Ultimately, it is crucial to consider the objective function to be optimized (contribution to profit, revenue or market share) and the constraints, which in this case could correspond to the maximum capacity of the hotel, as well as “last room availability” commitments with some customers, and general price positioning rules (minimum and maximum rates).

An optimal price point for each transaction

As the chart shows, willingness to pay declines and expected margin increases when price increases, reaches a maximum and then decreases. An optimal price point can consequently be calculated depending on the objective function and the constraints reflecting the enterprise’s pricing policy.

This optimal price point is indeed different for each transaction because willingness to pay and incremental margin (as well as constraints) may be specific too.

Why you must develop a price optimization approach

Many companies still set their prices based on intuition (for example applying flat increases to their historical tariffs) and use spreadsheets to manage complex pricing decisions. Let us see why these basic approaches are not relevant anymore.

- Millions of decisions. In all industries the number of pricing decisions is increasing. Examples:

- An international airline that operates 1,000 flights per day with an average of

20 rates per flight, sets prices daily on each flight starting one year in advance of departure. It will then be making more than 2.6 billion pricing decisions a year. - A leading manufacturer that has 50,000 product references sold in 50 countries

through 3 distribution channels with list prices and quarterly promotions will be

making over 37 million pricing decisions a year. - A domestic logistics network generates 4,000 quotes per year.

Each quote involves, on average, 3 services, 50 destinations and 10 weight brackets, leading to more than 6 million pricing decisions a year.

- An international airline that operates 1,000 flights per day with an average of

- Price differentiation. Because the optimal price is specific to a customer transaction, many enterprises differentiate their offers and their prices. However, the degree of price differentiation (unique price per product, price differentiated by segment or personalized price) is a strategic decision that depends upon regulation, market practice and the maturity of the pricing function within the enterprise. Hence, price differentiation complexifies each pricing decision.

- More dynamic decisions. Additionally, the determinants of price (competitors’ prices and costs) evolve faster and faster, which means that all environments are gradually becoming more dynamic. A price that was set yesterday may no longer be valid today.

- Shorter time frame. Pricing decisions, which are complex because they imply multiple factors, have to be made in a short amount of time. Responding quickly to an RFQ is sometimes critical to win a deal. Furthermore, e-commerce makes it mandatory to automatically process customer requests and produce quotes in real-time.

The stakes of greater precision through price optimization are high: they typically bring an increase of 3 to 7% net margin. Moreover, enterprises that do not adopt this approach run the risk of losing ground to their more advanced competitors.

Learn more in our simulation: Impact of More Accurate Costs and Willingness to Pay Calculation on Margin.